EBC Markets Briefing | London shines again among Europe

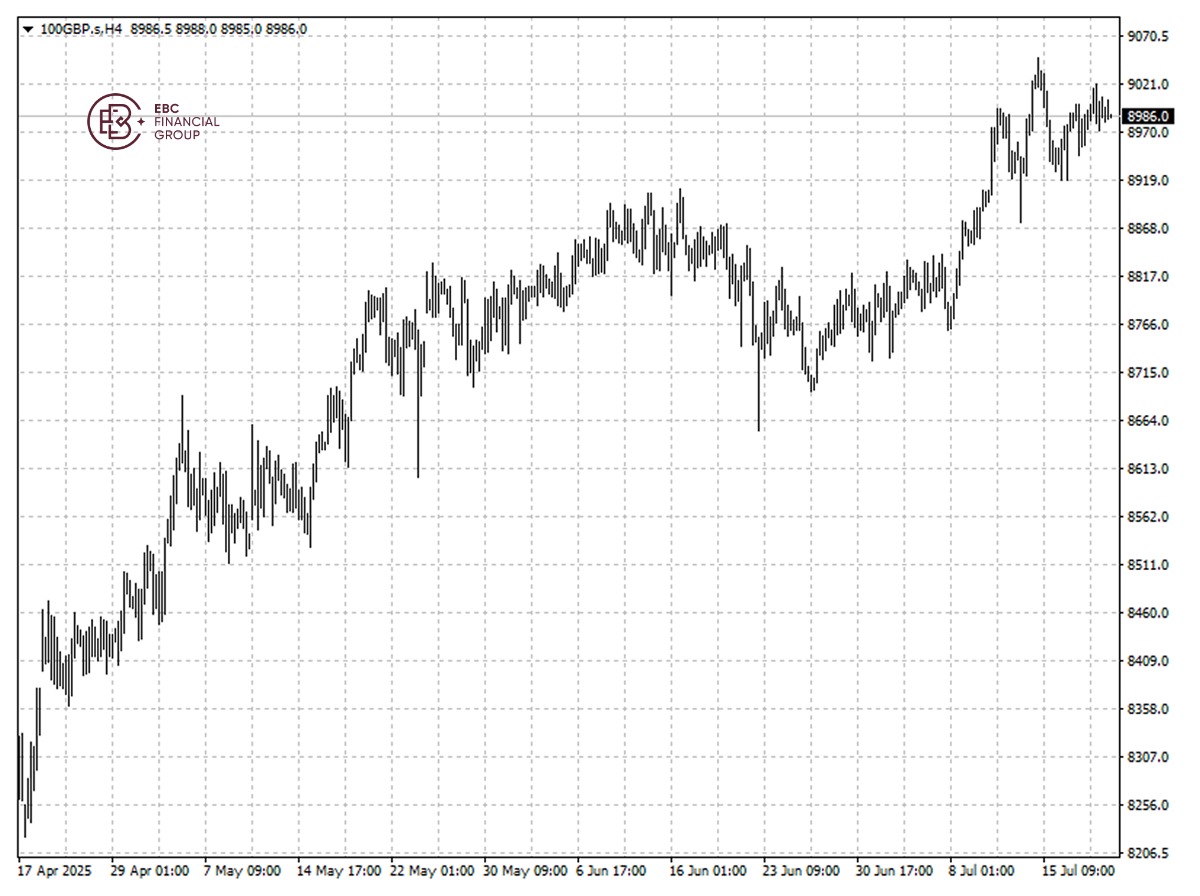

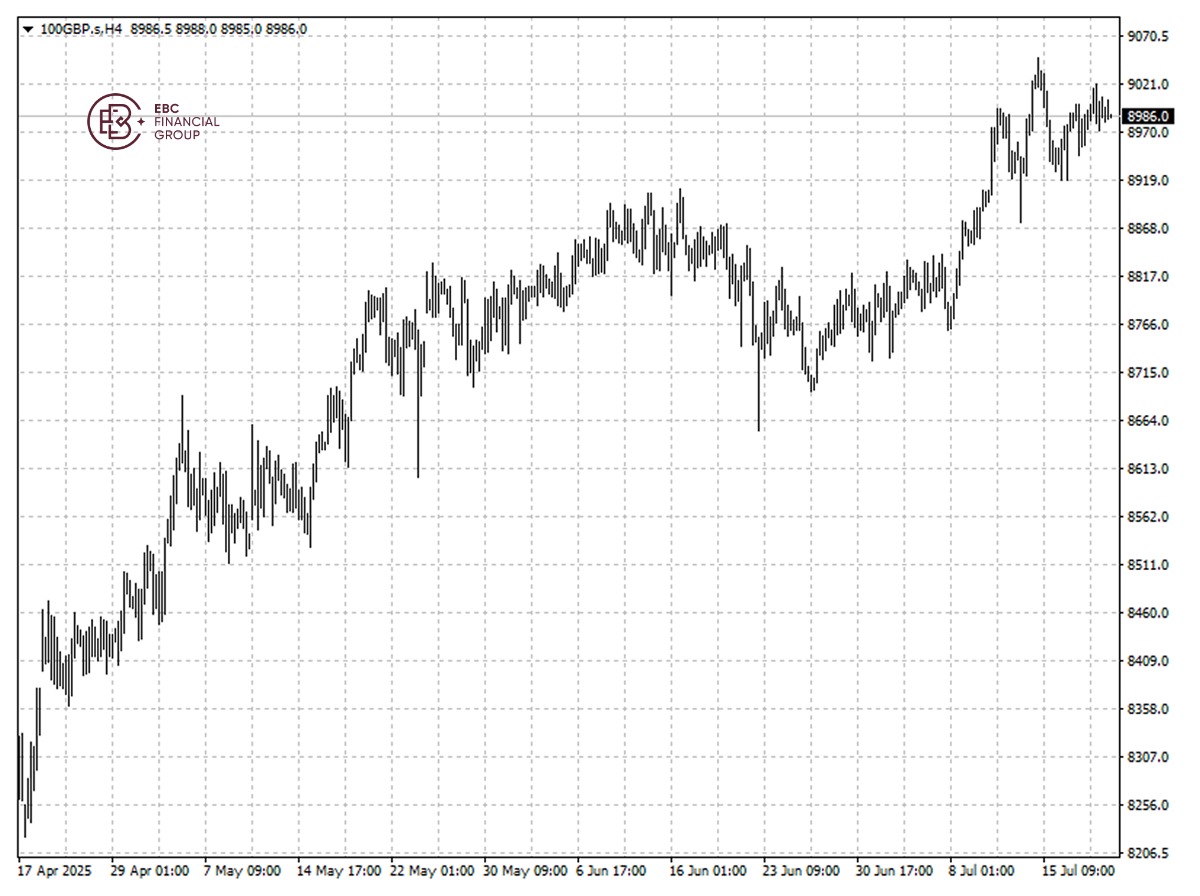

The FTSE 100 ticked higher on Friday following a week which saw indices touch record highs in the UK and US. Investors were buoyed on Thursday by a softening on jobless claims and stronger-than-expected retail sales.

Britain's stock market finally appears to be reversing years of underperformance, as a UK-US trade deal, deregulation and lower valuations deliver juicy returns that are starting to attract foreign investors.

The benchmark index has performed better than its European counterpart for the last six weeks, its longest such stretch since late 2022, when a weak pound beefed up revenues for multinationals.

The pound has been up 7% this year against the dollar on global diversification away from US assets in response to heightened US tariffs, but has notched a loss of roughly 4.5% against the euro.

The FTSE 100's 12-month forward price-to-earnings ratio of 12.5 is the highest for around five years, compared with 14.11 for the STOXX, the narrowest gap in around 18 months, LSEG data shows.

However, the economy contracted unexpectedly for a second month running in May, official data showed, compounding worries at home for finance minister Rachel Reeves as the nation navigates growing global turbulence.

Britain's stock market finally appears to be reversing years of underperformance, as a UK-US trade deal, deregulation and lower valuations deliver juicy returns that are starting to attract foreign investors.

The benchmark index has performed better than its European counterpart for the last six weeks, its longest such stretch since late 2022, when a weak pound beefed up revenues for multinationals.

The pound has been up 7% this year against the dollar on global diversification away from US assets in response to heightened US tariffs, but has notched a loss of roughly 4.5% against the euro.

The FTSE 100's 12-month forward price-to-earnings ratio of 12.5 is the highest for around five years, compared with 14.11 for the STOXX, the narrowest gap in around 18 months, LSEG data shows.

However, the economy contracted unexpectedly for a second month running in May, official data showed, compounding worries at home for finance minister Rachel Reeves as the nation navigates growing global turbulence.

The FTSE 100's uptrend remains intact considering the bullish pennant pattern. A push above 9,000 would reinforce the case.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The FTSE 100's uptrend remains intact considering the bullish pennant pattern. A push above 9,000 would reinforce the case.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Disclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2025-07-21 09:25:21 (GMT)

Britain's stock market finally appears to be reversing years of underperformance, as a UK-US trade deal, deregulation and lower valuations deliver juicy returns that are starting to attract foreign investors.

The benchmark index has performed better than its European counterpart for the last six weeks, its longest such stretch since late 2022, when a weak pound beefed up revenues for multinationals.

The pound has been up 7% this year against the dollar on global diversification away from US assets in response to heightened US tariffs, but has notched a loss of roughly 4.5% against the euro.

The FTSE 100's 12-month forward price-to-earnings ratio of 12.5 is the highest for around five years, compared with 14.11 for the STOXX, the narrowest gap in around 18 months, LSEG data shows.

However, the economy contracted unexpectedly for a second month running in May, official data showed, compounding worries at home for finance minister Rachel Reeves as the nation navigates growing global turbulence.

Britain's stock market finally appears to be reversing years of underperformance, as a UK-US trade deal, deregulation and lower valuations deliver juicy returns that are starting to attract foreign investors.

The benchmark index has performed better than its European counterpart for the last six weeks, its longest such stretch since late 2022, when a weak pound beefed up revenues for multinationals.

The pound has been up 7% this year against the dollar on global diversification away from US assets in response to heightened US tariffs, but has notched a loss of roughly 4.5% against the euro.

The FTSE 100's 12-month forward price-to-earnings ratio of 12.5 is the highest for around five years, compared with 14.11 for the STOXX, the narrowest gap in around 18 months, LSEG data shows.

However, the economy contracted unexpectedly for a second month running in May, official data showed, compounding worries at home for finance minister Rachel Reeves as the nation navigates growing global turbulence.

The FTSE 100's uptrend remains intact considering the bullish pennant pattern. A push above 9,000 would reinforce the case.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The FTSE 100's uptrend remains intact considering the bullish pennant pattern. A push above 9,000 would reinforce the case.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.